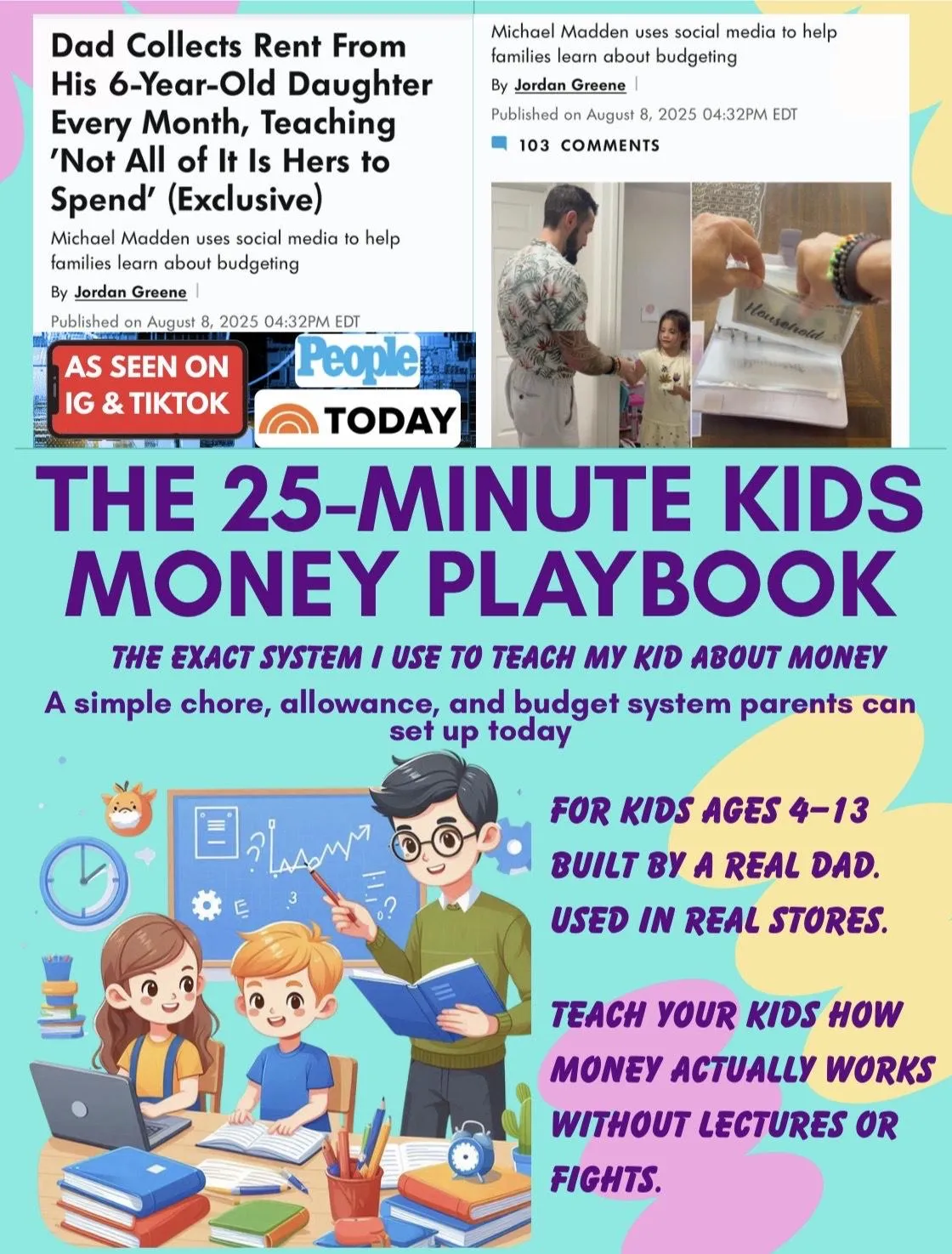

The 25-Minute Kids Money Playbook

The exact system I use to teach my kid about money without lectures or fights

As Seen on Instagram and TikTok. Used by Thousands of Parents

Set up chores, allowance, and a kid budget in 25 minutes

Teach real-world money habits starting today

Designed for busy parents with kids ages 4–13

Worried they’ll pick up bad money habits? Start small, start now.

Start their money smarts

Short, parent-led activities that make money talk simple — no lectures, just real practice.

- Teach real-world money skills in under 15 minutes a week

- Turn allowance, chores, and shopping into simple lessons

- Reduce money stress and raise confident, generous kids

Ages 4–13 · Designed for busy parents

One-time purchase — $27 · Lifetime access

“Within a month, our kids were asking smarter questions about money than most adults I know.”

— Sarah & John, parents of 9 & 12-year-olds

Backed by educators, tested by real families.

Who this is for

Parents or Grandparent of kids ages 4–13

Families who want a simple money system at home

Parents tired of fighting about chores and allowance

People who want practical money habits, not lectures

Loved by busy parents

Why this matters now

Most schools don’t teach money. Your home can.

Kids Money Playbook gives you a simple, scripted path to raise money smart kids, without becoming a finance expert or adding more to your plate.

Kids learn by doing

Short, activity-based lessons turn allowance, chores, and everyday spending into teachable moments kids actually remember.

Parents get scripts & structure

Exact words, printable tools, and checklists so you never wonder "am I teaching this right?" again.

Built for real family life

Bite-sized lessons you can do over breakfast, in the car, or while grocery shopping. No special setup required.

How it works

3 Simple Steps to Build Money Habits

Set it up once, use it weekly with your child, and watch them build real money habits.

Step 1

1) Set up the system

Spend 8 minutes on the parent primer and set up the tools.

Step 2

2) Use it weekly with your kids

Do a short activity each week—games or real tasks that teach money skills.

Step 3

3) Watch them build real money habits

Celebrate small wins and notice growing confidence and skills.

Inside the playbook

6 core modules that grow with your child.

Kids Money Playbook is a simple system parents lead at home — not a classroom course. Short, guided activities show you how to turn everyday moments into money lessons that fit your family.

- Chore charts kids can follow

- A budget binder with simple templates

- Scripts and prompts for real-life money conversations

- Practical routines families can stick with (weekly check-ins, allowance flow)

You also get:

Average time commitment: 15–20 minutes per activity.

Printable money trackers + jar labels

Easy, kid friendly pages that help your child see where their money goes. Designed to work with real cash and jars so lessons actually stick.Age based money guidelines (ages 6–8, 9–11, 12–14)

Clear recommendations for chores, pay ranges, and expectations so you’re not guessing what’s appropriate at each stage.Parent conversation prompts

Simple, ready to use scripts that help you talk about money without lectures, arguments, or awkward moments.Free updates + bonus printables

Any improvements, new trackers, or bonus lessons get added automatically at no extra cost.

For parents who want their kids to be prepared, not pressured.

You don’t have to have it all together with money to give your kids a better start. We start where you are and walk alongside you.

Perfect for:

- Busy families who want simple, done-for-you guidance

- Parents who didn’t grow up with healthy money models

- Homeschooling families looking for a money curriculum

- Grandparents who want to gift money wisdom, not just money

“We used to argue every time our kids asked for something at the store. Now they check their own trackers, compare prices, and make a plan. The emotional drama is gone.”

— Jenna, mom of 7 & 10-year-olds

Imagine your child at 18…

…already knowing how to budget, avoid debt traps, save for goals, give generously, and grow money over time. That’s what you’re building now.

Meet a dad

A dad who built this at home

Hi, I’m Michael. I’m a husband and dad of two, and I tested these routines at home with my daughter when she was six. What started as a simple way to teach her responsibility turned into a system that actually worked in real life.

Built and tested with my kids at home

Short, practical routines — no theory

Designed for real life, not perfect parents

My goal: give busy parents simple, practical money habits that actually work.

Parent stories

What families are seeing at home

“Our 8‑year‑old now asks where money should go before spending it — and actually follows through.”

— Aaron & Lisa

“Instead of arguments, we get quick chats about choices, and our teen explains their thinking.”

— Monica, mom of 13-year-old

“The course gave us simple, practical ways to talk money. Now our kids ask better questions.”

— Daniel & Priya

The 25-Minute Kids Money Playbook

A simple, parent-led weekly system — just 25 minutes a week — to help your child build lifelong skills with money, in a way that fits real family life.

- Simple weekly routines parents can follow

- A chore and money-tracking system kids use

- Guided conversations parents can use with their kids

One-time purchase — $27 · Lifetime access

No subscriptions. Easy to use for busy families.

Designed for busy parents — practical, tested, and classroom-informed.

Join when you’re ready

Lifetime access for your whole household.

One-time payment. No subscriptions. Go at your own pace and revisit lessons as your kids grow.

6 core modules plus all future updates

Printable trackers, scripts, and family money templates

Bonus: Teen money mini-track (coming soon)

30-day "love it or it’s free" guarantee

Kids Money Playbook

$27

One-time payment · Lifetime family access

Secure checkout · All major cards accepted

Bonus when you enroll today: "Money Talk Cheat Sheets" for tough conversations (divorce, debt, and more).

Complete enrollment when you’re ready

Complete enrollment below at a time that works for you.

Simple 30-Day Guarantee

Try the system. Set it up. Use it at home.

If it’s not a fit for your family, just email us within 30 days and you’ll get a full refund. No questions asked.

What age is this best for?

The core playbook is designed for ages 6–14. Each module includes age-adjusted options and examples for younger kids (6–8), tweens (9–11), and early teens (12–14), so you can tailor the activities to each child.

How much time will this take each week?

Most families spend 15–20 minutes a week: 5–8 minutes for you to watch the parent video, and 10–15 minutes to do the activity and conversation with your child. You can stack modules on a weekend or stretch them over several months—totally up to you.

Do I need to be good with money to teach this?

No. You don’t need to be a money expert or have a perfect financial life. The playbook gives you the scripts, examples, and tools so you can learn alongside your kids. Many parents find that doing the activities also improves their own habits.

How long do we have access?

You get lifetime access for your household. That includes all the videos, downloads, and any future updates or bonus lessons we add to Kids Money Playbook.

Can I use this with multiple kids?

Yes. Your enrollment covers your entire household. You can print materials as many times as you’d like and repeat modules with younger siblings as they grow.

The money conversations you wish you had as a kid—made simple for yours.

Start Kids Money Playbook when you’re ready — at your pace and comfort.

One-time payment of $27 · Lifetime access · 30-day guarantee